Matchless Info About How To Get Out Of An Irs Levy

Learn the steps to take to avoid an irs levy.

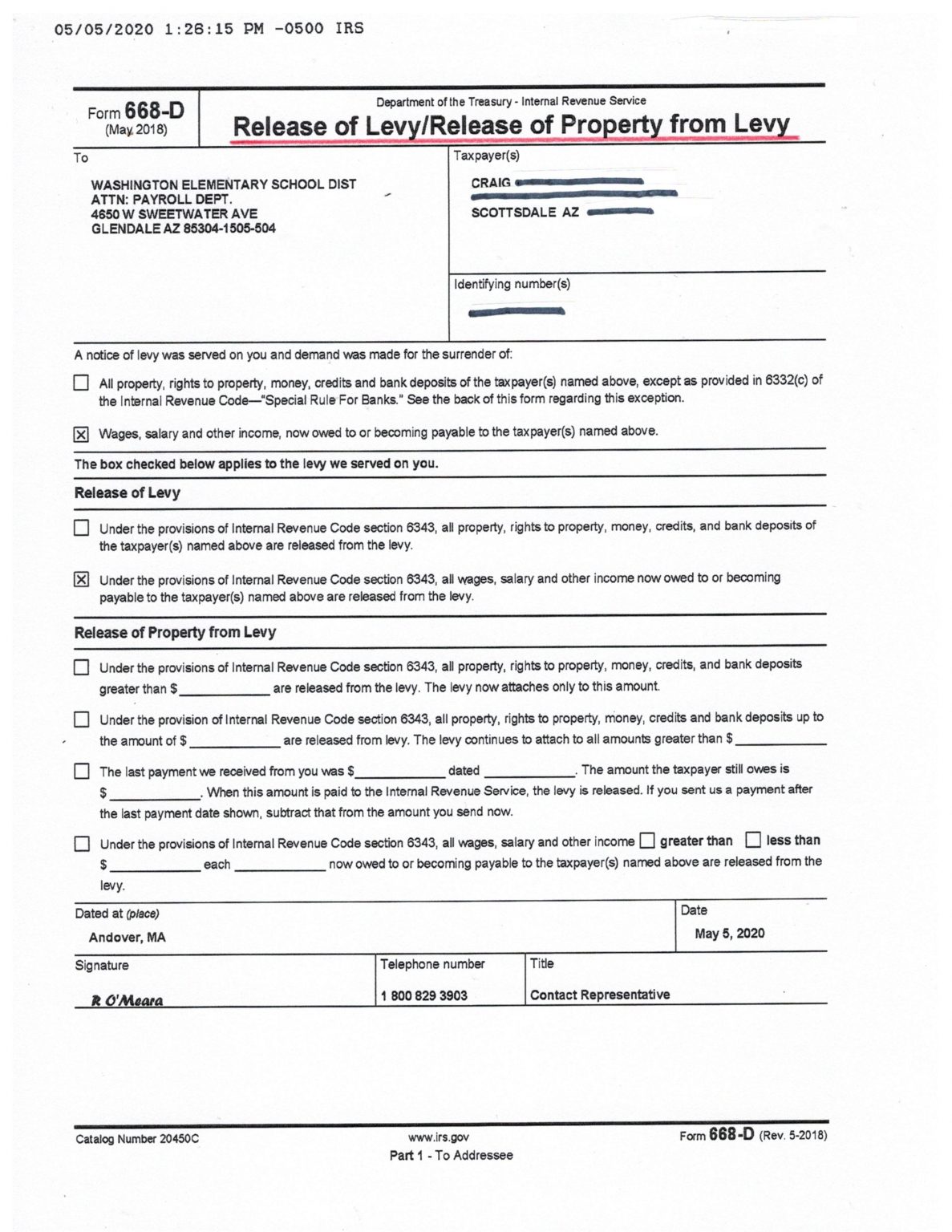

How to get out of an irs levy. Tax problems tax levy release levy how to release an irs levy: If a release of levy from the irs is not received within 21 days of receipt of the levy, funds in the account as of the date and time the levy was received must be sent to. Removing a levy or wage garnishment when the irs takes money out of your bank account (levy) or your paycheck (wage garnishment), you have options.

Now, figure out how you’re going to get the levy released. This means you are running out of time before the irs can levy your bank. How to stop an irs levy.

The taxpayer fails to pay the tax bill. Many taxpayers can avoid a levy by entering into an installment. Tax is assessed and the taxpayer is sent a notice and demand for payment.

Levies are different from liens. Levying your state tax refund through the state income tax levy program (sitlp) under the state income tax levy program, we may levy (take) your state tax. If the irs levies your.

In short, a tax levy is when the irs legally seizes your property or your rights to property with the intent of selling it to satisfy your back taxes. Here are the basic steps of how an irs bank levy works: Contact the irs right away.

Notice of intent to levy and notice of your right to a hearing. Irs sends a levy notice to your bank ordering them to seize funds. If you don’t appeal the levy or make payment arrangements with the irs by the deadline on the notice, the levy could move forward.

Remove federal tax levy once the irs starts to levy your assets, the agency will continue to take assets. To do that, you need to fill out and submit irs form 12153 (request for a collection due process or equivalent hearing) or request the cap procedure ( collection appeals. Here are the six ways you can get.

How do i get a levy released? Apply for an irs payment plan. Keep reading to learn more about the steps you can take to get an irs levy released from your property.

You don't have to pay your full tax bill by the due date — as long as you take the proper steps to make alternative plans. 6 ways to get an irs bank levy released. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help.

If you can’t pay what. Once that happens, you may. If you have received a notice of intent to levy or are worried that the irs may be seizing your assets soon, you need to take action.