Exemplary Info About How To Handle A Credit Card

To build credit, you need to obtain credit—and opening a credit card account can be a way to accomplish that goal.

How to handle a credit card. Click the edit ( pencil) icon next to pay in the employee details. put. You can still use cash or a debit. Of the three credit bureaus, experian offers the best user experience.

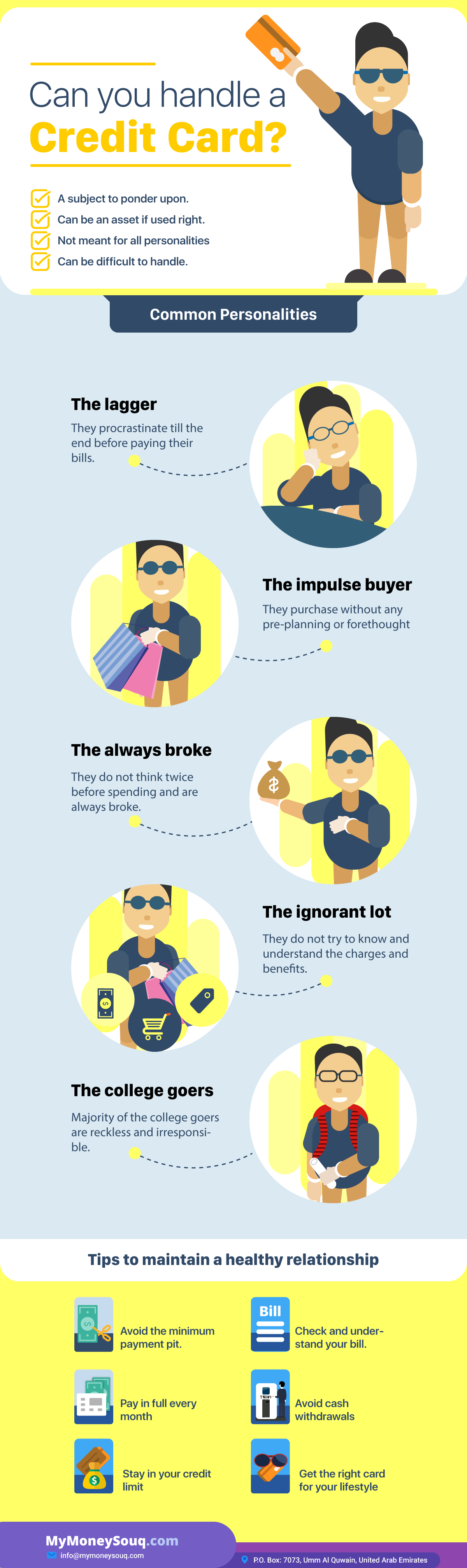

Don’t spend more than you can afford and pay off your balance every month on time. A few basic rules you, as a cardholder, can follow for the extent of your credit card’s life will keep it easy. The best way to handle credit cards is to spend frugally and pay promptly.

Among these are two key pieces of wisdom: Managing your credit card debt is key to maintaining healthy finances and a strong credit score. When that happens, it can be beneficial to consider credit.

Continue to pay your credit card bills on time paying on time means no late fees and other charges. The debt snowball method requires you to put extra funds toward your debt with the smallest balance each month. Use the debt avalanche method follow a budget pay within 30 days set up autopay get professional help consider a balance transfer credit card look into a debt consolidation.

Thieves use various methods to commit credit card fraud including application fraud, skimming and physical theft. Having a concrete repayment goal and strategy will help. With a balance transfer, you'll shift your debt from one card to.

You can request a credit freeze from one credit bureau. But for those people already struggling, the following are some simple steps for reducing. After all, the high interest rates that credit cards can come with make credit card debt difficult to pay off.

Still, it’s totally ok to forge your own financial path based partially on family lore,. There’s a premium membership for $24.99 monthly that adds benefits like a credit score. Understand the different card types if you've never had a credit card before, you'll need to figure out what credit card to get.

Start by using your first credit card for a basic expense or two each month, and be sure to pay the entire balance when it’s due. You want to use the card to get out of debt, not add to it, she says. Be sure to monitor your credit card accounts, develop safe.

Paying the entire balance on time means you won’t be. The easiest way to get a better interest rate is applying for a 0% balance transfer credit card. Using a credit card is as simple as you make it.

Once you do that, the other two bureaus will receive the notification. With a heloc, you'll have a line of credit to pull from as you need, and you'll only pay interest on the cash you use. The method i used to get out of debt—and what i teach others to follow—is the debt snowball method.