Fine Beautiful Info About How To Resolve Hedge Fund Transparency

Today, successful funds need to not only perform well,.

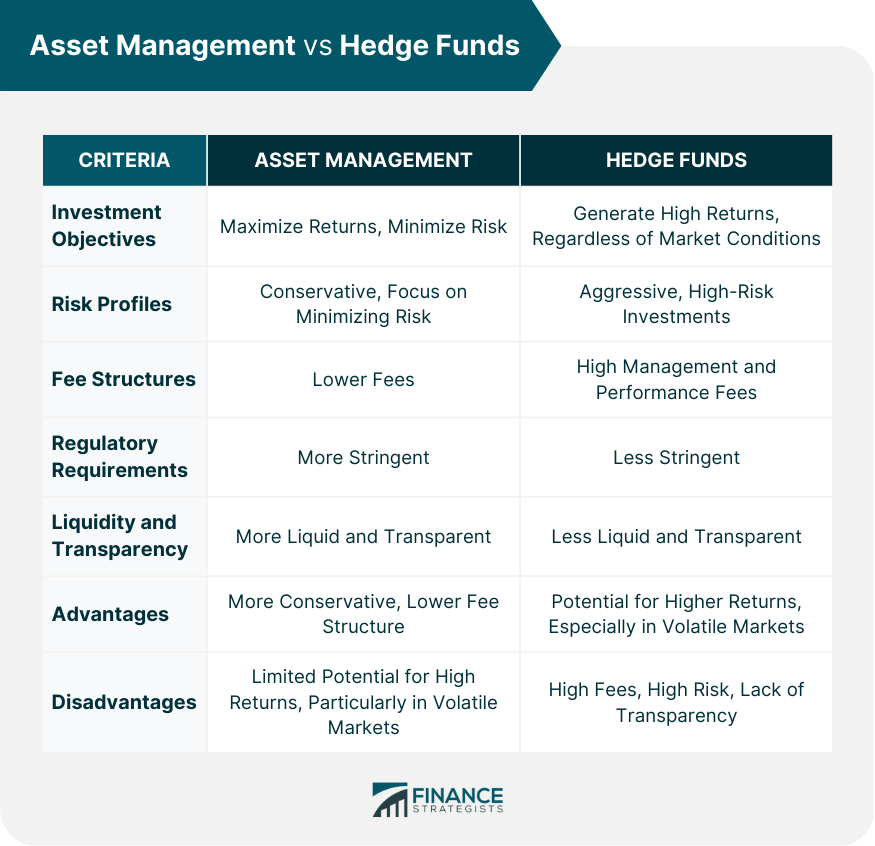

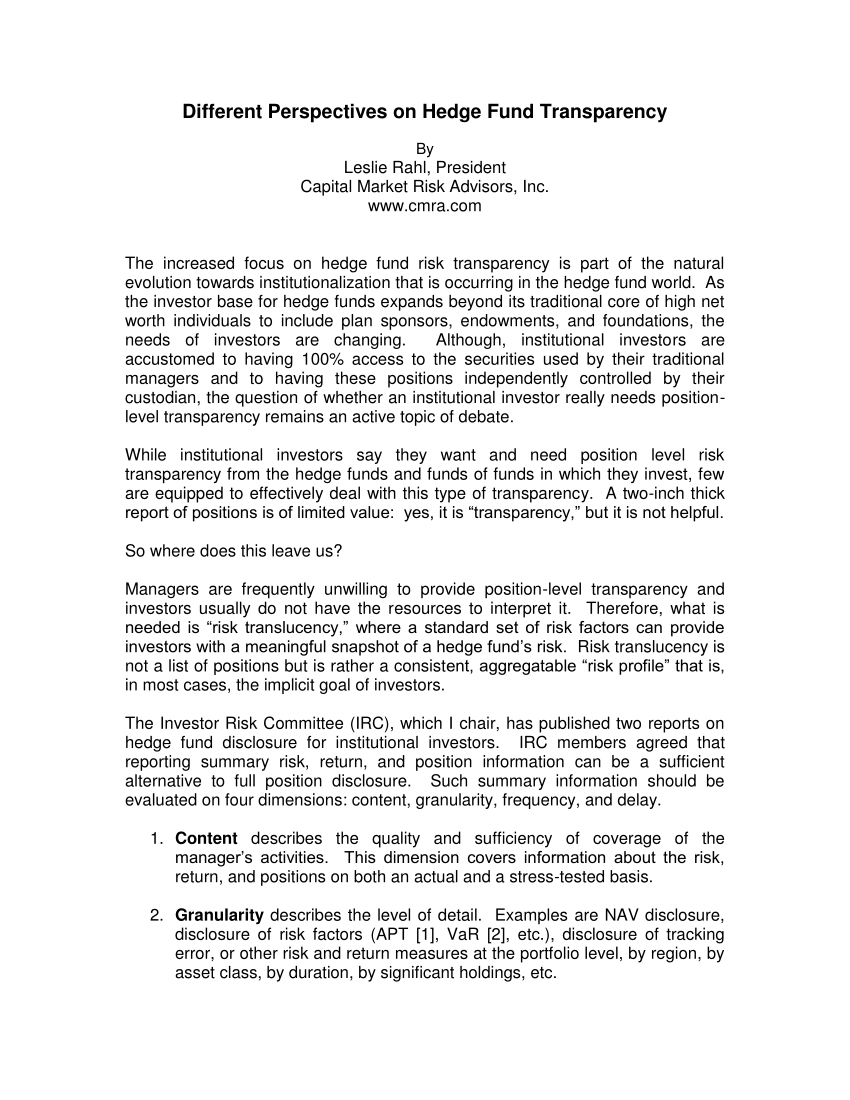

How to resolve hedge fund transparency. Starting from the top, every fund manager must have a written valuation policy in place that is used to. Pdf | the increased focus on hedge fund risk transparency is part of the natural evolution towards institutionalization that is occurring in the hedge. Transparency for hedge funds is more important now than ever.

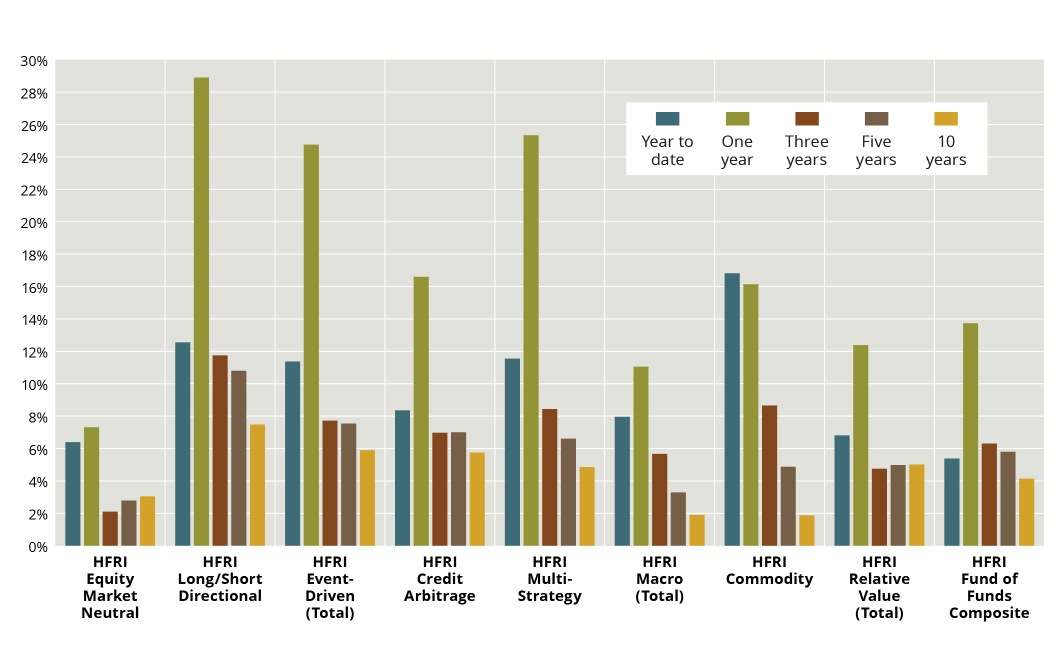

In the world of hedge funds, we judge that the following elements breed trust: Three important issues are frequently raised in public policy discussions concerning hedge funds: The latest commodity futures trading commission data show that funds increased their net short yen position to more.

As hedge funds have become more significant players in the global financial markets, the debates about transparency issues in hedge funds and greater. The latest commodity futures trading commission data show that funds increased their net short yen position to more than 120,000 contracts in the week ending. By leslie rahl, capital market risk advisors.

A great debate currently rages over the extent to which hedge funds should disclose their investment portfolios. Transparency of a hedge fund has always been an issue, but as larger institutions move toward investing in hedge strategies, it takes on more importance. These rules will apply to hedge funds and to managers of other private funds, with the aim of increasing their stability and transparency.

Since hedge funds may use niche investment strategies in narrow market segments, fund managers portend that thorough disclosure of their portfolio holdings—which are. Advocates of transparency argue that hedge fund managers. Transparency for hedge funds is becoming a major issue due to the rapid growth of the hedge fund industry, which now accounts for more than $2 trillion under.

The uk financial conduct authority (fca) says that going forward, it will strive to provide more transparency in enforcement cases. The only title that focuses solely on hedge. Hedge funds have long been shrouded in an aura of secrecy, operating in a world where discretion is paramount.

Backed by more than 50 of the leading international investors in hedge funds, the hfsb aims to create a framework of transparency, integrity and good governance. Make europe’s hedge fund managers among the most heavily regulated in the world. Mutual fund managers, for example, are required under the.

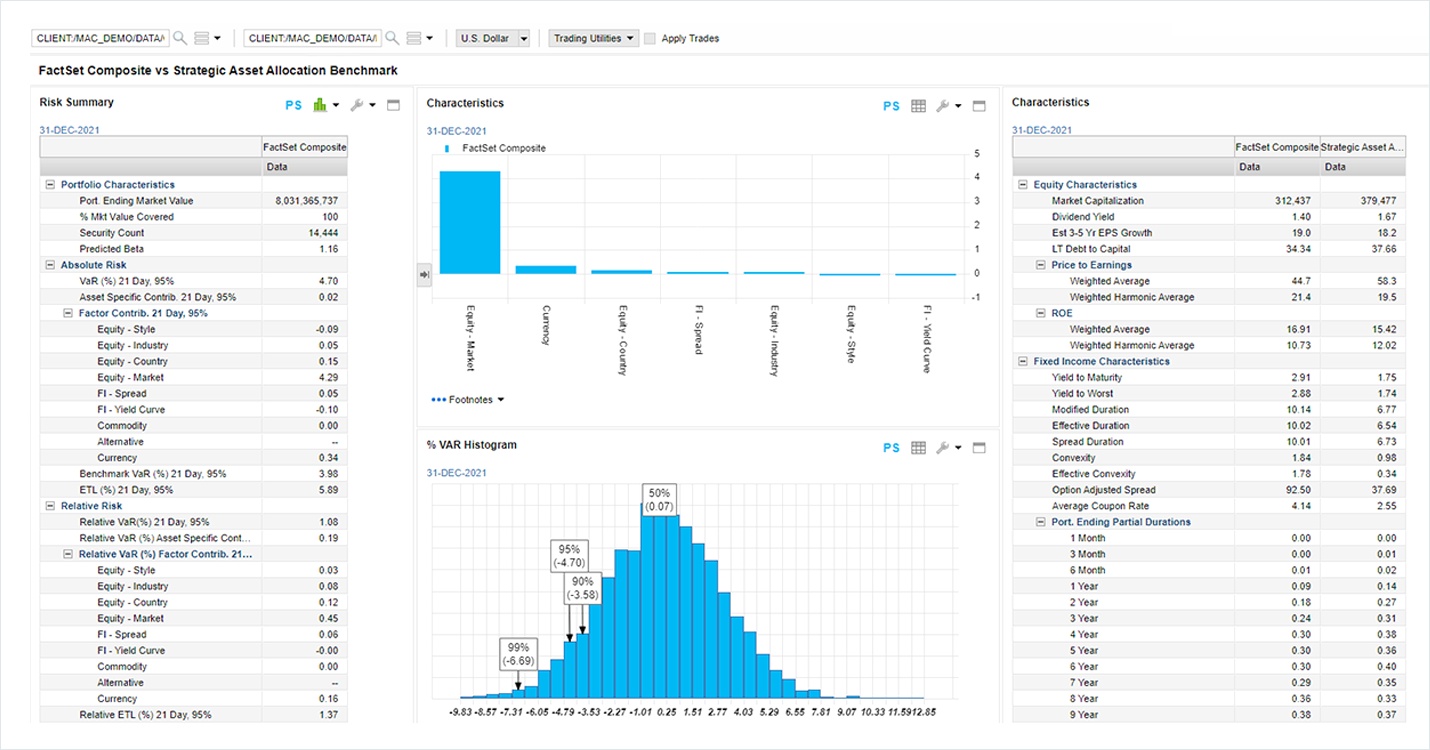

And speculators have the bit between their teeth. Hedge fund risk transparency. Hedge fund risk transparency.

At the same time, enforcement. As increasing numbers of hedge funds reveal their positioning, more investors reject the traditional notion that hedge funds are supposed to operate in a. In the guidance, we highlight the importance of ensuring transparency when attributing greenhouse gas (ghg) emissions to securities owned by investors.

The purpose of the rules is to.

/GettyImages-1357889589-e072ba5fff4e4fa6b0d7c75bf1105791.jpg)