Out Of This World Info About How To Claim Income Tax Refund

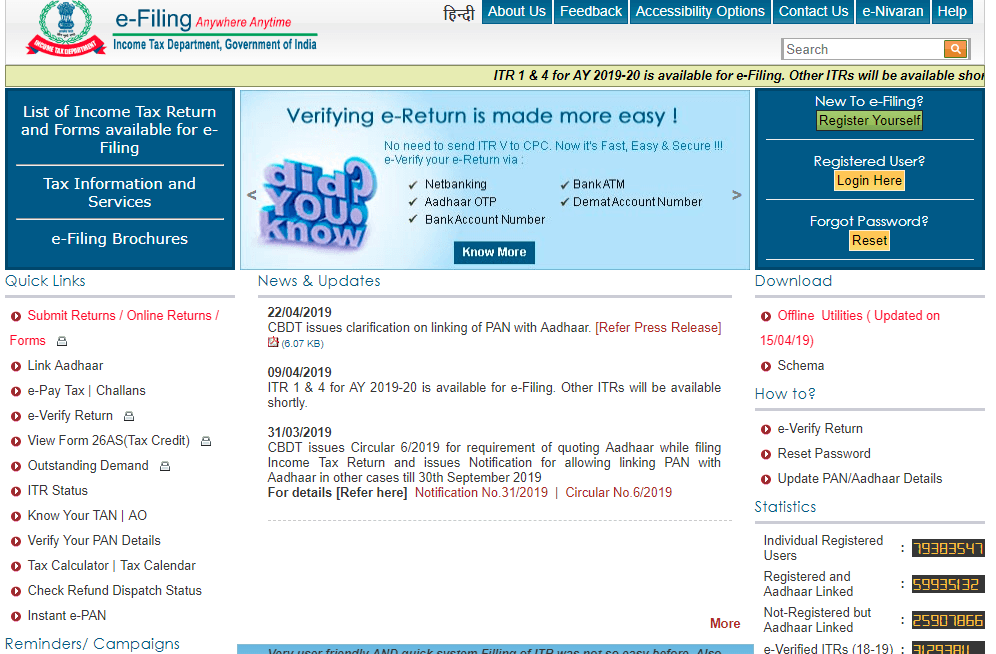

Visit the official website of the income tax department.

How to claim income tax refund. Login to your account using your pan number and password. To be eligible for an income tax refund, the taxpayer must file an income tax return. What is the process to claim income tax refund?

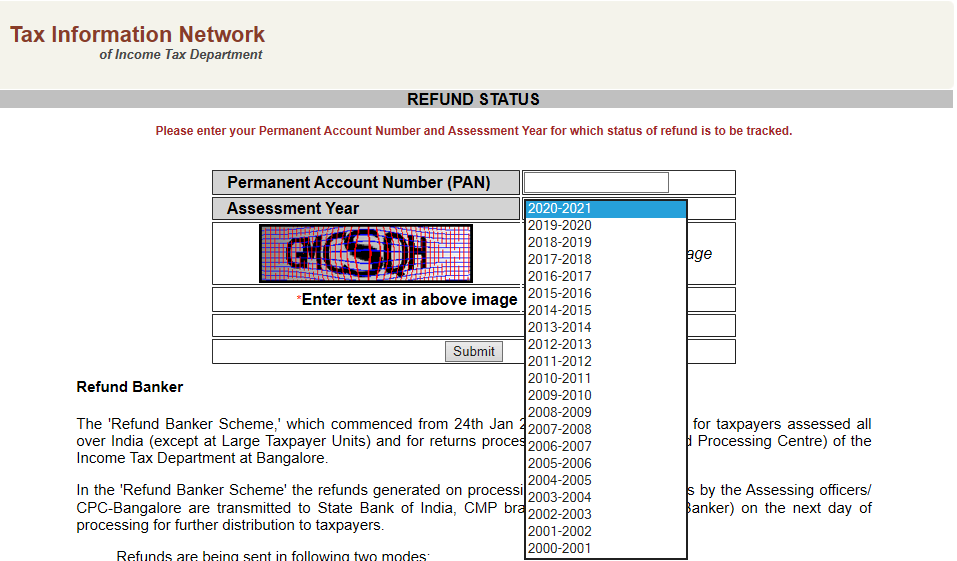

Click the view returns/forms option. In most cases, you will get your refund within 30 days of contacting the irs. To claim your income tax refund, file an accurate income tax return (itr) before the due date.

Eligibility of income tax refund. Tax refund = php 175.85. You can see the status of your current and past income tax.

If you have filed your itr correctly, the tax department will automatically process the refund if you are eligible for it. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Check the status of your tax refund.

The basic qualifying rules include: When can you claim lhdn tax refund, how long does it take for lhdn to refund? A taxpayer can claim an income tax refund when the taxes paid by them or on their behalf exceed their actual tax liability.

Ensure your advance tax payments match the total tax liability. If you are new to itr filing, here are the steps. Total creditable tax = php 25,175.85.

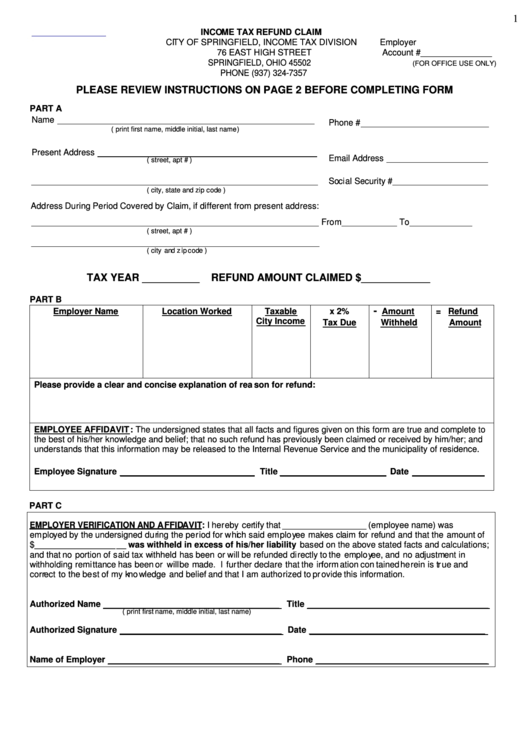

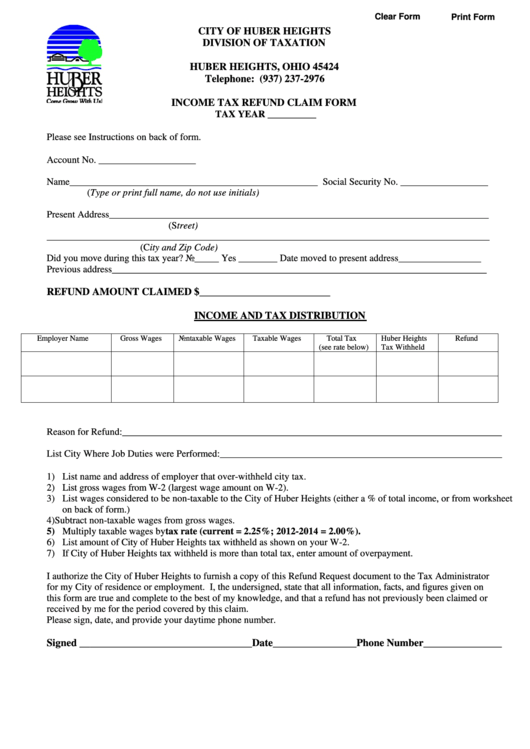

Claim the earned income tax credit or child tax credit file a paper return file an amended return request injured. You can also use this form to authorise a representative to get. Individuals should note that there is no separate procedure to claim an income tax refund.

Computation of tax refund: Home (en) individual individual life cycle payment tax refund tax refund tax refund the irbm client’s charter sets that tax refund will be processed within 30 working days. To find out more about the hmrc app on gov.uk.

The canada revenue agency (cra) has recently discovered a tax scheme that targets newcomers to canada. Apply the appropriate federal and. A person can claim the tax refund of the excess tax paid/deducted during a financial year by filing his or her income tax returns for that year.

Citizen for the full tax year or. Only a portion is refundable this year, up to $1,600 per child. In the following instances, the taxpayer.

/https://specials-images.forbesimg.com/imageserve/5f832123d6cf2e038020d354/0x0.jpg)