Fine Beautiful Info About How To Claim Ltc

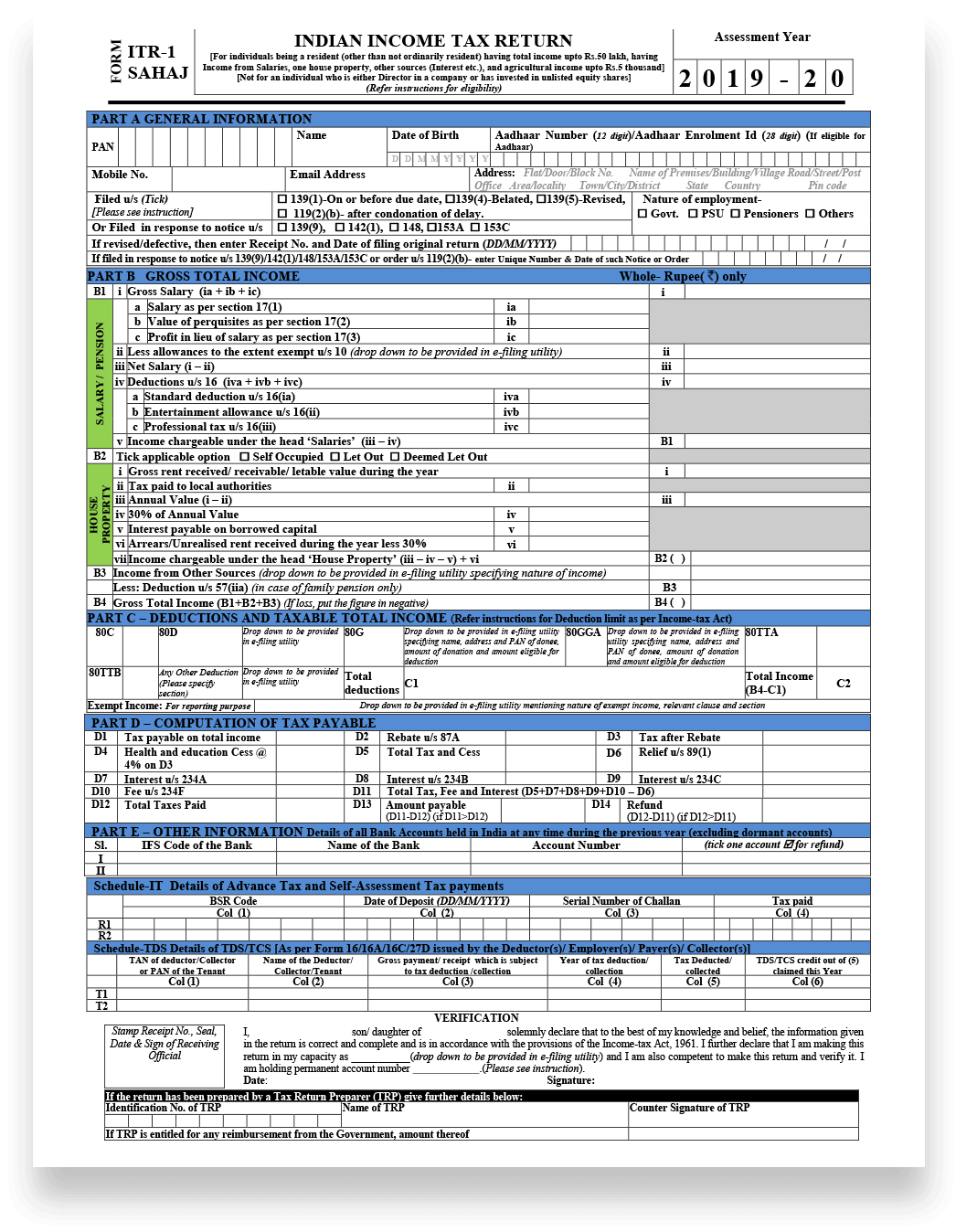

This scheme is an alternative to the leave travel concession tax benefit [ ltc / lta] that is currently available in income tax.

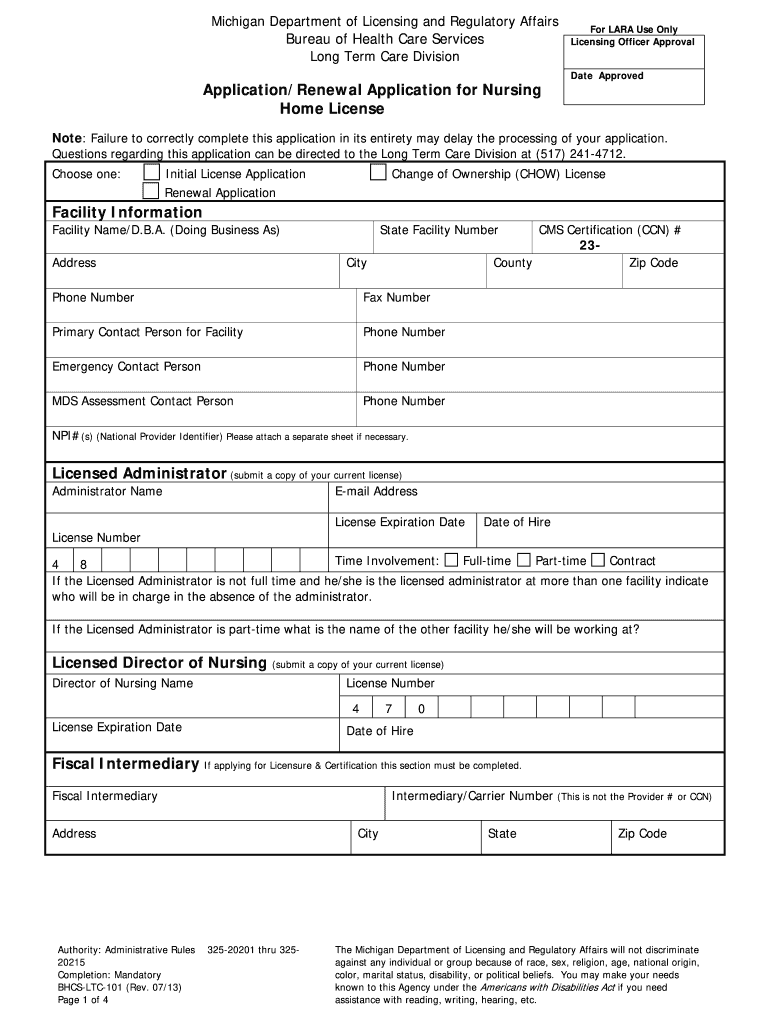

How to claim ltc. Leave travel concession (ltc) is nothing but a type of salary component where your employer is providing some yearly benefit to travel with your family. Conditions for claiming ltc/lta let us understand the conditions/requirements for claiming the exemption. The claim should be a valid trip made by you between the leaves which you have applied in your.

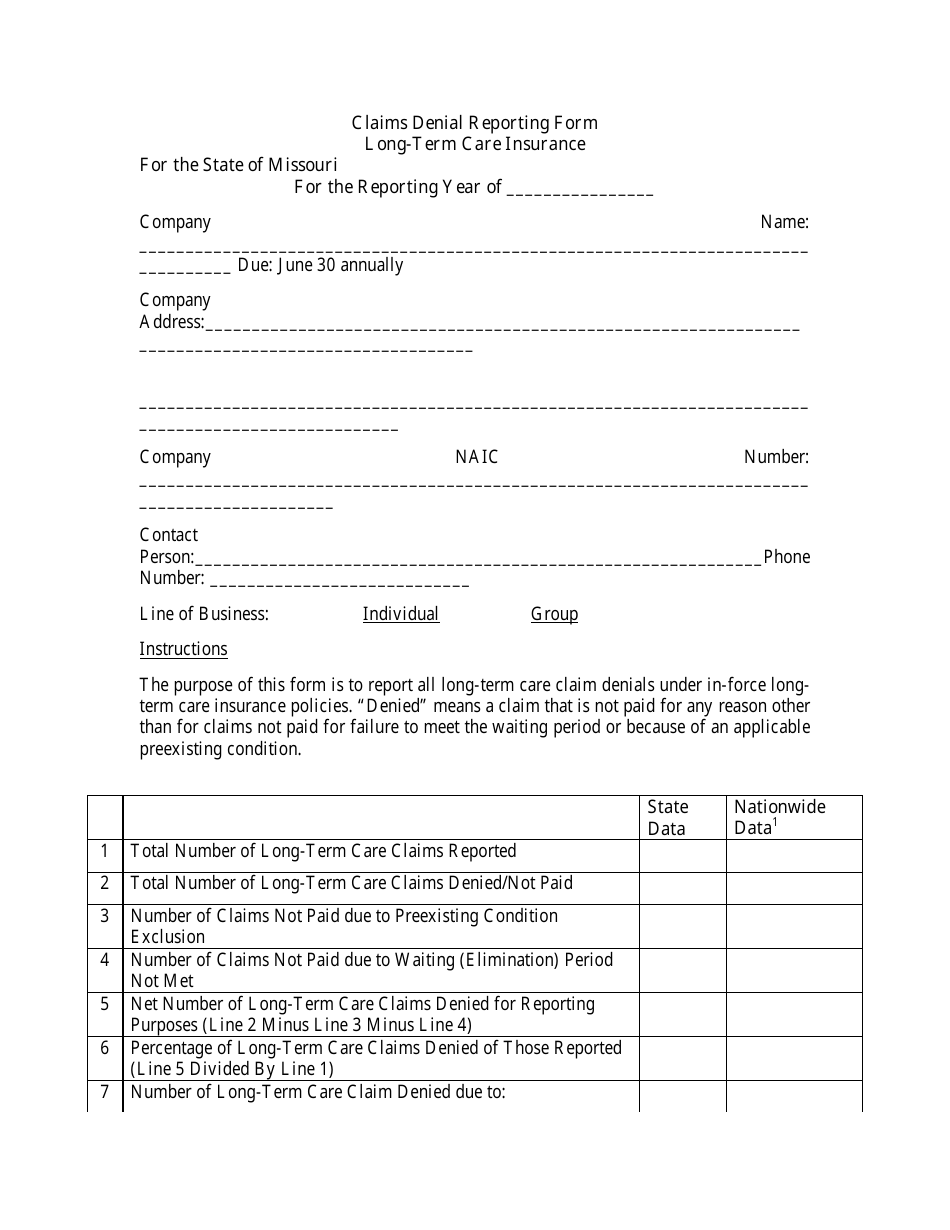

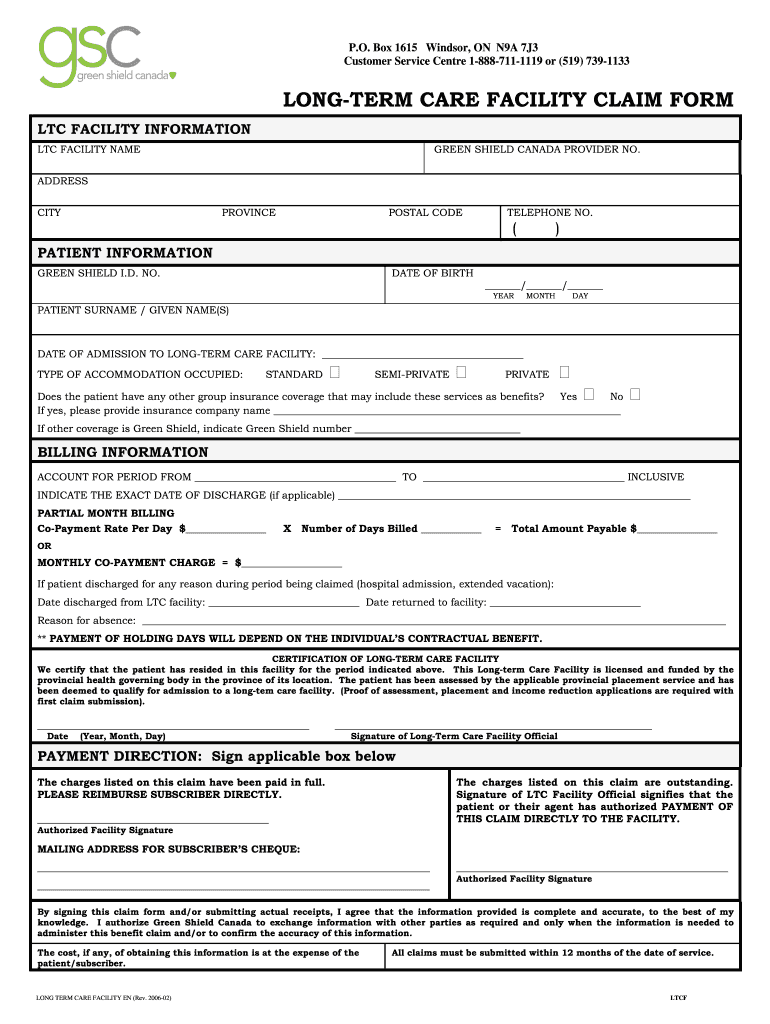

Where advance has been drawn, the claim for reimbursement shall be. However, the employee must submit a valid. The amount of lta exemption depends on the lta component in your compensation package or ctc.

In order to claim the benefit under the lta cash voucher scheme, the taxpayer or his/her family member should have spent on the purchase of goods and. However, the employee must submit a valid proof of cost to claim the leave travel. Ltc is the amount paid by the.

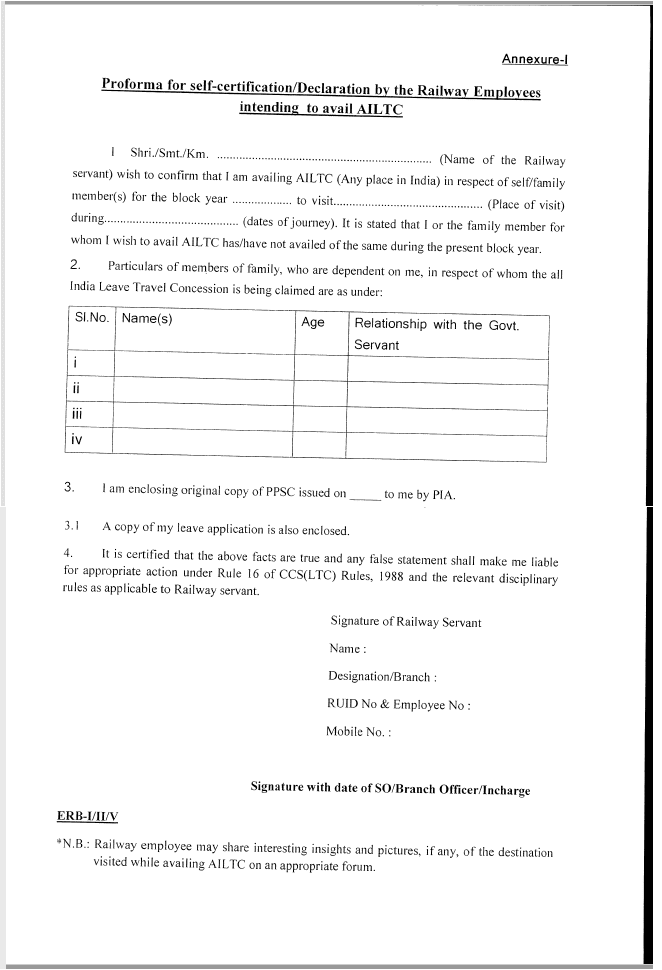

Procedure to claim ltc procedure to claim ltc is generally organisation specific. Actual journey is a must to claim the. Conditions to claim ltc.

The ltc cash voucher scheme was announced by the finance minister nirmala sitharaman in october 2020 to boost consumer demand and to provide tax. This amount is also sometimes referred to. Reimbursement of catering charges in case of ltc;

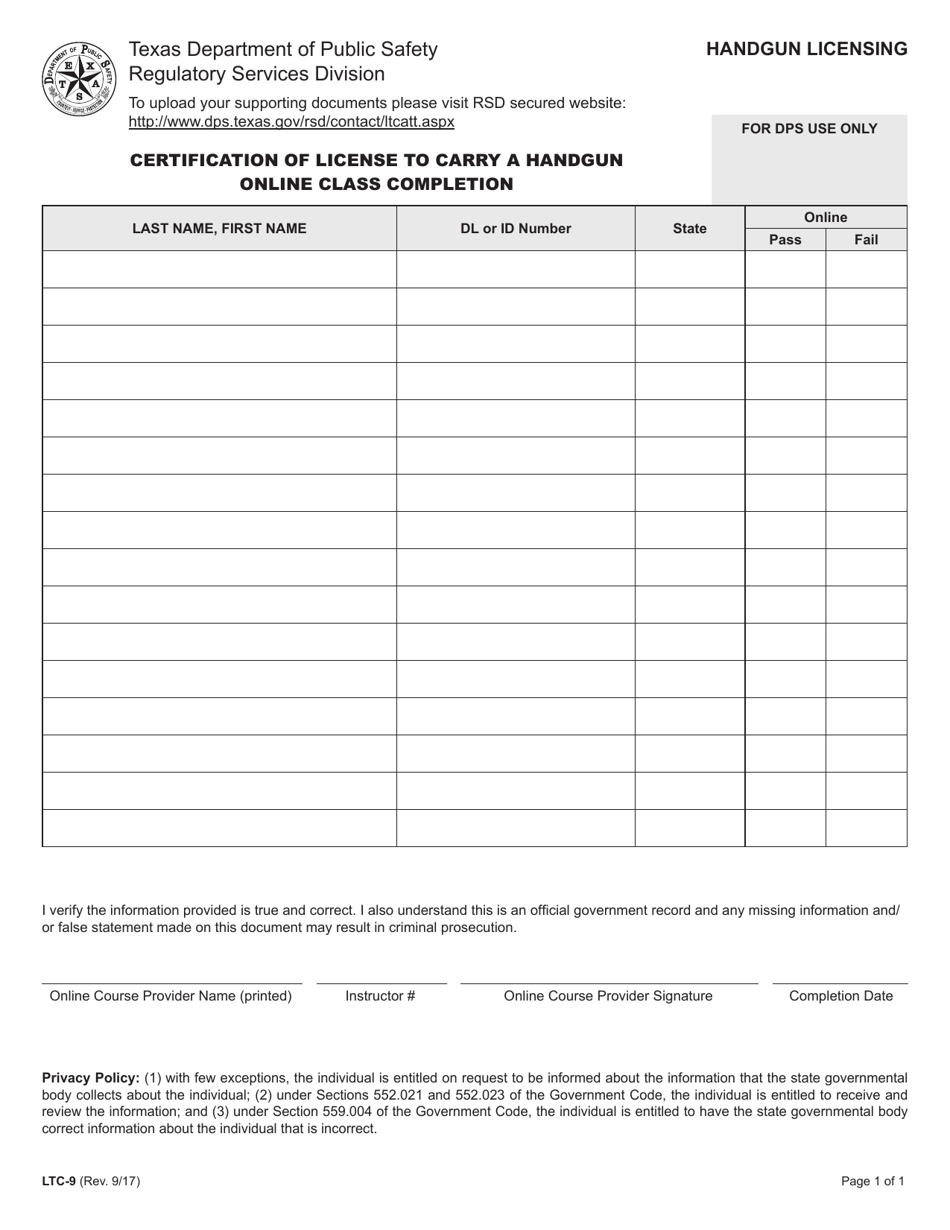

All the mediums of the travel i.e road, rail or air are claimable under lta. How and when to claim? What is leave travel allowance?

What is the eligibility of lta exemption? You can furnish proof of travel within the block period and claim up to the amount prescribed in your ctc. To claim ltc under the income tax act, you generally need to submit the following documents:

Definitions change of hometown declaration of place of visit under leave travel concession to any place in india admissibility of leave travel concession types of. How are the claims of ltc be adjusted in case of delayed submission? How much can i claim tax exemption in leave travel allowance or lta?

Simply, you can claim for ltc from your company. What is the latest block period. How to claim lta/ltc understanding fare exemptions lta lta/ltc:

Ltc new instructions, clarifications and modifications dopt order 2023. Every organisation announces the due date within which ltc can be claimed. The ltc scheme requires employees to spend three times the amount of deemed ltc fare on the purchase of goods/services, having a gst rate of 12 per cent.

![[PDF] Leave Travel Concession (LTC) Bill Form PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/leave-travel-concession-ltc-bill-form-2450.jpg)